The 3 Greatest Funding Challenges Startups Face (and How to Overcome Them)

September 30, 2021Building your own company is exciting, but it can also be hard, and it requires investment, a lot of it. Finding funding has and always will be a challenge for any startup, but having adequate financial resources is critical to your company's ongoing success. According to an Inc.com article, "only 4 out of 100 businesses survive past the 10-year mark. Why do most businesses fail? Because they can't pay their bills." So, obviously, having adequate funding will be crucial to your success. Still, convincing others to invest in your great idea without having a business track record can be challenging and time-consuming.

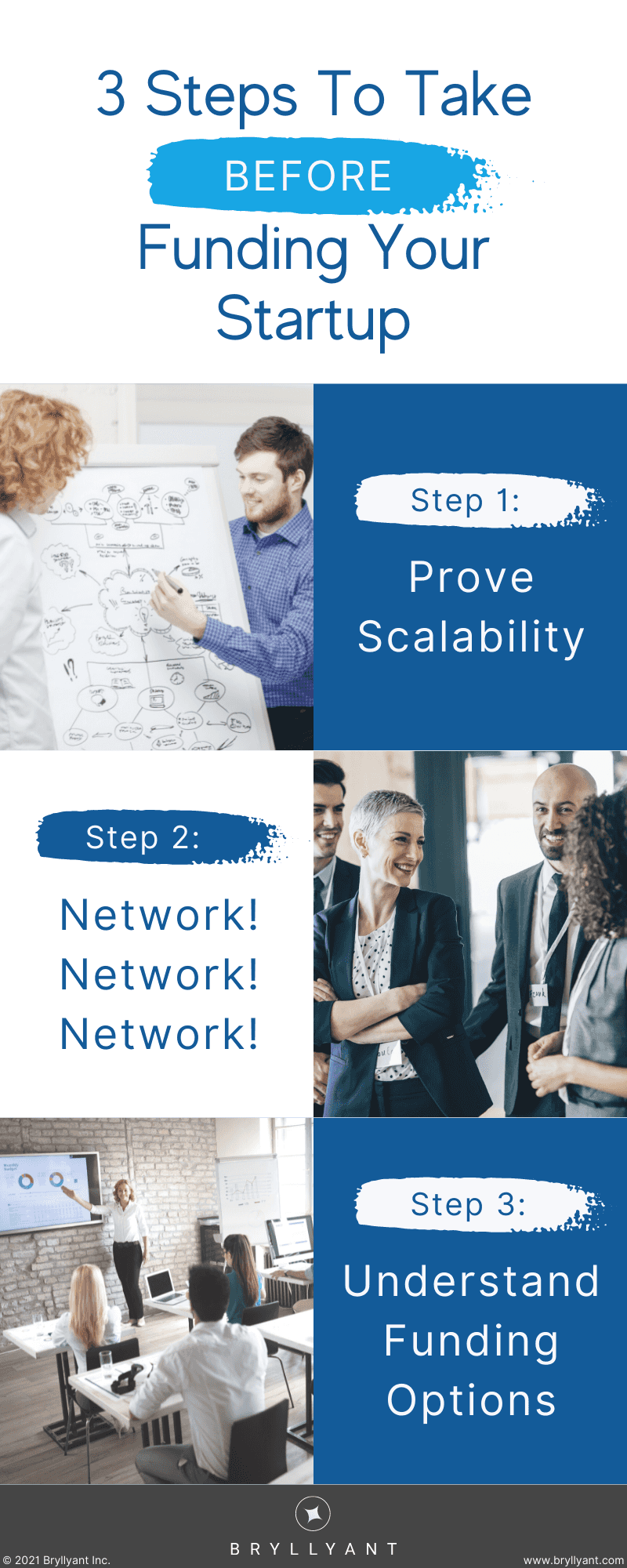

So how does a founder overcome funding challenges and realize their vision? By first understanding the top three funding challenges that startups face and addressing them head-on.

1. Ignoring Scalability

One of the top reasons founders struggle to secure funding is that they cannot communicate how they will scale their company. Funders will want to know how you will use their money to take your business to the next level and ultimately understand how they will receive a return on their investment. Entrepreneurs often communicate to funders how they will grow. Growth, the direct progression of current processes, is good; however, its linear nature requires significant resources to support and maintain. Funders want to see scalability, making possible growth and increased revenue without significantly increasing costs.

Funders want to see scalability, making possible growth and increased revenue without significantly increasing costs.

How does a startup ensure that its business is scalable?

- Scale smart by examining your processes and only work "hands-on" with your core competencies

- Outsource where you can

- Automate the rest

- Identify and eliminate roadblocks to organizational growth

- Dive deep into your product/service

- Plan for innovation

- Build a structure that works for you, not vice-versa

- Focus on continuous improvement and build an open-ended strategy

2. Going It Alone

Going it alone and trying to get your startup to the next level is insanely difficult. Many founders think that since they are entrepreneurs they must be islands unto themselves. Neil Patel says that that’s not necessarily the case. He shares that, "at its core, networking is about building relationships. It's about getting people to know, trust, and want to do business with you. The personal and professional connections that you forge can be leveraged to boost your business exponentially."

In-Person Networking

While geographic proximity can make connecting with others in-person somewhat challenging, there are likely still some nearby opportunities that will work for you. Seeking out networking events for professionals in your industry will help you build collaborations and partnerships that are relevant to you as a founder. Author and Speaker J. Kelly Hoey shared Five Rules for Networking Your Startup In A New City:

-

Skip The Sales Pitch: Your goal is to make long-term connections, not merely to close a funding round or land a business deal.

-

Know Before You Go: Do your research on the investors or companies you want to meet, and the city you'll be meeting them in.

-

Learn The Unwritten Rules: Every city operates a little bit differently, and the more you understand those nuances, the more successful your network-building will be.

-

Warm Introductions Work Best: The foundation of a strong introduction is trust

-

Understand Communication Preferences: To build a strong network you need to recognize the communication preferences of the other person.

Online Communities/Platforms

If you can’t find any in-person networking events in your area, or if you have scheduling conflicts that get in the way, you can always turn to digital networking opportunities to help you on your funding journey. Platforms like Reddit, Discordapp, Angel.co, and Indie Hackers, for example, have huge communities with connections to potential investors.

3. Not Knowing How Funding Works

Finding the right financing for your organization is vital as each type of funding comes with its own processes and challenges. Understanding these options and how they work can make the process a little less daunting.

Funding Options

Startups go through various stages of development, and the funding options available will vary based on each stage. There are also gray areas between stages of development and how a startup is bringing its tech to market.

Pre-Seed

Pre-seed is funding designed to help a startup of its initial operations. As the purpose of this funding is to get the business up and running, it is not technically considered a formal round in the funding cycle. The investors who usually provide startups with pre-seed funding are the founder, their close friends, and family members. Inc42 shares that typically:

- Pre-seed funding average ticket sizes are low due to the nascent stage of startups- amounts usually range from $10,000- $250,000

- The timing and the manner of raising pre-seed funding are critical to the success of the startup

- One of the biggest challenges is convincing investors to put money in startups that have no real traction

Seed Funding

At this stage, your startup already is a real business with a product, a team, and possibly a sales channel. The goal at this phase is to utilize the next influx of investments to grow the business. This expansion should include product development and marketing, and other efforts to help you scale.

Angel Funding

Angel investors are individuals who have significant financial capacity, are usually experienced investors, and are seeking a higher rate of return than they can receive from more traditional investments. A Forbes article explains how angel investors fill the gap between friends and family and more formal venture capital funds. Some invest purely for profit. Others look to make an impact on their funds by investing in causes and industries they are passionate about. Typical angel investments range from $10K to $1MM.

Accelerators and Incubators

For early-stage startups, accelerators and incubators offer a means to grow their businesses. Information Age interviewed Louis Warner, COO, at the Founders Factory. He shared that an incubator "is where we take ideas and fantastic founders, and through a process, we start companies that can solve problems, and that can be scaled using technology. Usually, an incubation period lasts over six months." He added that "an accelerator takes existing companies, with an existing team and existing idea, and accelerates them by improving all aspects of the operation, getting them into the best position to scale faster. An accelerator's function is there to help a company grow rapidly." Incubators and accelerators can help startups quickly produce a product or service which can then be tested in the market.

While both incubators and accelerators offer an environment of collaboration and mentorship, they vary in the investment capital which they provide. Incubators do not traditionally provide capital to startups and are often funded by universities or economic development organizations. They also don't usually take an equity stake in the companies they support. Accelerators do invest a specific amount of capital in startups in exchange for a predetermined percentage of equity. Due to this investment, the accelerators bear a greater responsibility in the success of the startup.

Venture Capital

For most founders, once you have moved past the seed funding stage, the only thing standing between you and the next leap forward is an influx of capital. A round (or more than one) of venture capital can help you take those next steps.

Venture funding refers to an investment from a venture capital firm (VC) and describes Series A, Series B, and later rounds. A breakdown of the rounds is listed below:

Series A

In a Series A round, VC's look for startups that already have a business model, and they are expected to use the money raised to increase revenue. Investments at this stage typically range from $2MM to $15MM. Some of the largest Series A VC's are New Enterprise Associates (NEA), Andreessen Horowitz, Accel Partners, Bessemer Venture Partners, Sequoia Capital, Greycroft Partners, and GGV Capital.

This is the funding stage at which more than half of startups fail. According to CB Insights, less than half, or 48%, of startups managed to raise a second funding round.

Series B

At this stage, your startup has been in the marketplace for a while. The next round of funding is what your team needs to help you gain market share, or add new products and services to your business model. Since you have proven yourself, you are less of a risk, and the amount that VC's will be willing to commit will be higher.

Investopedia notes that the average estimated capital raised in a Series B round is $33MM. Companies undergoing a Series B funding round are well-established. Their valuations tend to reflect that; most Series B companies have valuations between around $30MM and $60MM, with an average of $58MM.

A list of some of the top Series B investors includes:

- Google Ventures

- New Enterprise Associates

- Kleiner Perkins Caufield & Byers

- Khosla Ventures

- General Catalyst Partners

Series C

Series C is the third injection of investment capital. Startups at this stage are considered "young mature." Series C funding is often used to enable a startup to take on a larger market share, acquire a competitor, or embark on an ambitious product development plan.

As investment in the business becomes even less risky at this stage, other groups such as hedge funds, investment banks, and private equity firms, often join the table as investors. In 2020, the average Series C funding in the U.S. is $59 MM. Typically, Series C funding ranges from $30MM and $100MM.

While some firms will move onto further rounds, it is quite common that a Series C is the final round before a company moves onto an Initial Public Offering (IPO) or an acquisition offer.

Making sure that your startup is scalable, you have a robust network, and you understand how funding works will help ensure that you are prepared to make that pitch when the opportunity presents itself.

Regardless of the tech, the market, or the stage of funding, any entrepreneur who has been there will tell you that securing financing is no easy task. However, being forewarned is to be forearmed. Once you are aware of the potential challenges, you will be able to address them head-on. Making sure that your startup is scalable, you have a robust network, and you understand how funding works will help ensure that you are prepared to make that pitch when the opportunity presents itself.