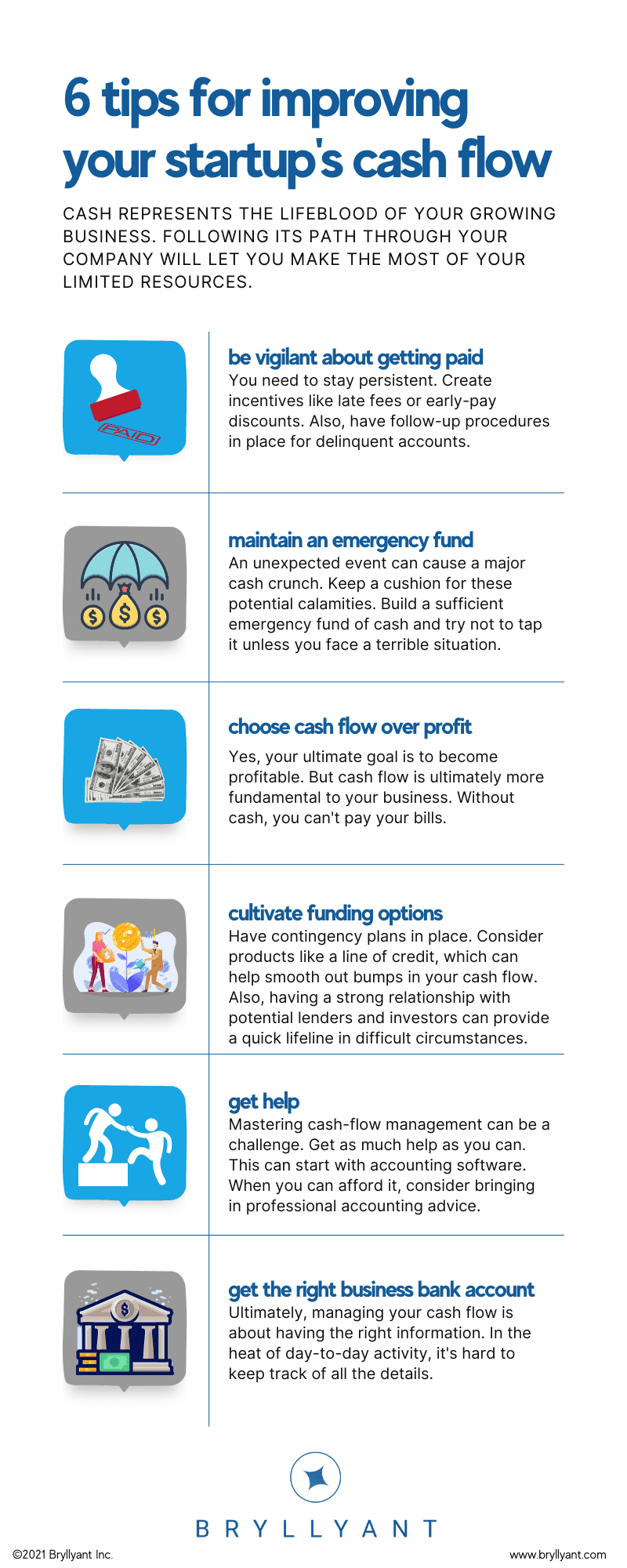

6 Tips for Improving Your Startup's Cash Flow

May 28, 2021Founding a small business requires a sudden crash course in accounting. Cash flow is one of the terms that becomes crucial as you ramp up your new startup. Understanding your business's cash flow - and knowing how to improve it - quickly becomes instrumental to launching a successful venture.

However, gaining mastery of cash-flow management can present a challenge. Early in your new business, you likely won't have an accounting department to support you. You might not even have access to a professional accountant. Just you, some accounting software, and an internet full of advice.

Still, an appreciation for the importance of cash flow will put you on the path to success.

Cash represents the lifeblood of your growing business. Following its path through your company will let you make the most of your limited resources. You can also identify points of improvement, letting you become more efficient and more profitable over time.

Cash represents the lifeblood of your growing business. Following its path through your company will let you make the most of your limited resources.

What Is Cash Flow?

Fundamentally, the name "cash flow" provides a good description of the concept. It describes the way cash gets moved in and out of your business.

Think of it like the way your body uses calories. You take in energy through food. Then, you use that energy to operate the body, fueling your brain, muscles, and other systems.

For cash flow, you take in cash from customers. Then, you use that cash to fuel the various parts of your business. You pay your employees, buy raw materials, fund R&D, and finance all the other functions you need to drive your startup forward.

Cash flow boils down to two main concepts:

-

Positive Cash Flow: You take in more cash than you spend. This represents the ideal situation. Imagine your bank account getting bigger at the end of each fiscal period - that's the impact of positive cash flow.

-

Negative Cash Flow: You spend more cash than you collect. You're burning cash, which means you need to bring in additional funds to keep your operations going. This can come through investment or borrowing. However, eventually, you'll run out of financial resources.

How Is Cash Flow Different Than Profit/Loss?

On the surface, profit and positive cash flow might seem like interchangeable terms. After all, both describe the amount of extra money your venture produced during a certain period of time.

However, it's rather common for a business to generate cash flow figures that are different from their profit numbers. That comes about because certain non-cash factors get included in profit/loss that don't influence cash flow.

Depreciation is a good example of this. Your profit/loss will be impacted by the charges you take for depreciation. However, these don't actually take place as a cash outlay. Depreciation (and other similar examples, like amortization) represents an accounting event, not an actual expenditure.

So, if your company has a lot of expensive equipment that requires depreciation, you might have a significant difference between your cash flow figure and your profit/loss number.

How to Calculate Cash Flow

Think about the relationship between cash flow and profit/loss. They track similar concepts, but profit/loss includes certain non-cash items. To get to cash flow, you simply need to take these factors out of the equation.

Essentially, to calculate cash flow, you start with your profit/loss. Then, you remove those non-cash considerations. Here's the concept as an equation:

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

Netflix: Streaming Through Cash

Netflix is a good example of the difference between profit and cash flow. The company often spends a significant amount to create new content. (New episodes of The Crown don't come free). The firm will routinely spend more than $2.5 billion a quarter to build its content library.

As a result, Netflix has many quarters in which it posts a net profit but ends up burning through cash. For instance, in the fourth quarter of 2020, Netflix posted net income of $542 million. However, it spent $3.3 billion on content and, after all the accounting was done, ended up with $284 million in negative cash flow.

It made a profit but had less cash to show for it.

6 Tips for Managing and Improving Cash Flow

To improve your business, you need to take your understanding of cash flow even further. It's one thing to know what it is. You also need to understand how to analyze cash-flow figures and improve them over time.

With that in mind, here are six tips for managing and improving your cash flow:

1. Be Vigilant About Getting Paid

Cash flow starts by receiving payments from customers. As a startup, you might be focused on building relationships. You might not feel like you have the leverage to insist on timely payments.

However, you need to stay persistent. If customers get in the habit of paying late, you might have trouble getting them to catch up. Create incentives like late fees or early-pay discounts. Also, have follow-up procedures in place for delinquent accounts.

2. Maintain an Emergency Fund

When you're running on a shoestring budget, an unexpected event can cause a major cash crunch. Keep a cushion for these potential calamities. Build a sufficient emergency fund of cash and try not to tap it unless you face a terrible situation.

3. Choose Cash Flow Over Profit

Yes, your ultimate goal is to become profitable and to grow that profit over time. But cash flow is ultimately more fundamental to your business. Without cash, you can't pay your bills. A paper profit doesn't do you much good if you face a cash crunch.

4. Cultivate Funding Options

To capture opportunities, you might have to dip into your cash reserve. Burning cash for a limited period can fuel a major expansion. However, you want to have fallback options if you get into a precarious cash situation.

Have contingency plans in place. Consider products like a line of credit, which can help smooth out bumps in your cash flow. Also, having a strong relationship with potential lenders and investors can provide a quick lifeline in difficult circumstances.

5. Get Help

Mastering cash-flow management can be a challenge. Get as much help as you can. This can start with accounting software. When you can afford it, consider bringing in professional accounting advice.

6. Get the Right Business Bank Account

Ultimately, managing your cash flow is about having the right information. In the heat of day-to-day activity, it's hard to keep track of all the details.

Ultimately, managing your cash flow is about having the right information.

The right online business bank account can make this tracking easy. Choose a bank that provides cash flow tools. This will help you gather data and figure out how to discover insights on how to run your business better.

Run Your Business Better By Understanding Cash Flow

Don't get overwhelmed by the math involved in tracking cash flow. The general concept will be familiar to any small-business owner. You want to take in more cash than you send out. Relatively simple.

However, gaining a more nuanced understanding of the topic will help you over time. Learn how to compute cash flow, get advice on how to maximize it, and rely on strong tools (like accounting software and the right online business bank account) to get the most out of your resources. By learning how to analyze and improve your cash flow, you'll put your startup on the path to success.