The Bottom Line - Learn to Better Track and Manage Your Small Business Expenses

June 25, 2021Why do most small businesses fail? The answer is probably simpler than you think: they run out of money. The story behind this might differ from company to company. But spending more than you earn over a long period of time will ultimately undermine your business.

That's why tracking your expenses is such a crucial task.

We know. You didn't found your startup to keep meticulous records of your expenses. You wanted a grand entrepreneurial adventure. And here we are telling you to write down the cost of every business lunch and every box of paper clips.

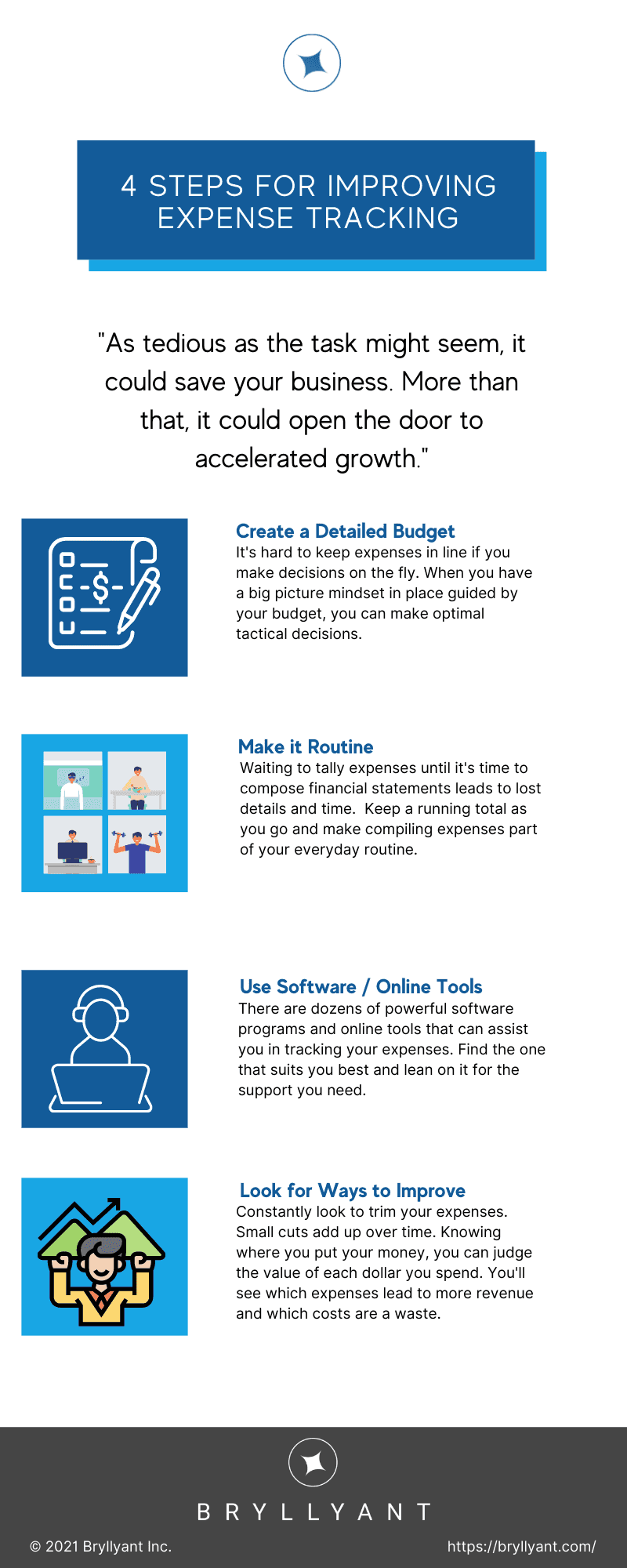

Still, as tedious as the task might seem, it could save your business. More than that, it could open the door to accelerated growth.

As tedious as [expense tracking] might seem, it could save your business. More than that, it could open the door to accelerated growth.

Why should I track and manage my expenses?

To reach profitability and fuel ongoing growth, you first need to know where your money is going. Tracking expenses lets you do this. By gathering this data, you can run your startup more effectively.

After all, how can you control expenses if you don't know what they are? Keeping a firm handle on outlays will get your small business on firm financial ground.

As you launch your startup, managing expenses lets you bring that breakeven point closer to reality. It also helps you as your business matures. Once you get into the black, a firm grasp of your costs will let you identify the best opportunities to pursue.

Tracking and managing your expenses gives you stability and financial security. At the same time, you can stay lean, even as you build a client base. Finally, you'll have the information you need to make intelligent decisions about expansion.

What business expenses should I be tracking?

It's not enough to simply write down every dollar you spend. You also need to know how to categorize those costs and what they mean for your bottom line. Here are a few types of expenses to keep in mind and how they play into the bigger picture of your operations.

Fixed

Fixed costs are those expenses that are unavoidable. They tend to remain stable from month to month. Think things like rent, insurance, and some salaries (the salary for an HR director would represent a fixed cost, for example).

You have to pay them no matter how many products you make or the services you provide. You're stuck with these expenses no matter what.

Variable

These expenses change as your output changes. This category includes things like raw materials and some types of wages.

For example, if you launched your organic cupcake business, products like eggs, sugar, and flour would fall under the variable heading. In addition, you can count the hourly wages for your bakers in this group as well.

Non-Cash

Not all expenses represent money leaving your bank account. These non-cash costs include things like depreciation. Getting a good accountant, or at least going through a crash-course on the basics yourself, will help you master these.

Let’s just run through a quick example. As you run the industrial mixers for your cupcake operation, the machines will begin to run down. You'll eventually need to replace them. This invisible (but very real expense) gets calculated through depreciation.

Interest

Technically, this belongs in the "fixed cost" category. However, since it has a different character than many of your expenses, we've broken it out into a separate subhead.

When you borrow money, you have to pay that back with interest. About 70% of small businesses have outstanding debt. These payments to lenders need to get tracked just as much as the costs directly associated with day-to-day operations.

What are the benefits of tracking my expenses?

So far, we've told you that tracking your expenses represents a critical task for any small business owner. But we haven't detailed why it's so central to success. Here are a few specific benefits that come from a painstaking understanding of your costs:

Understanding Your Business Better

Which products give you the best margins? Where should you invest your marketing budget? What products should you expand? Which ones should you consider cutting?

Detailed tracking of your expenses lets you answer these crucial questions. With a good idea of your various costs, you can produce an in-depth analysis of your business. As a result, you can make intelligent decisions about your future.

Save Money on Taxes

Itemizing your expenses can create great value when it comes to tax time. Certain costs come with tax benefits. By knowing where your money is going, you can take advantage of these incentives and lower your tax bill.

This is especially true for a startup or small business. Often your business and personal expenses get blended in ways that are hard to parse. A detailed ledger of what you've spent on your business will let you get all the deductions you deserve.

Find Places to Trim

By knowing your expenses, you can review which ones are truly necessary. You can hunt down places to cut costs and find efficiencies that will make you more profitable.

How can I better manage and track my expenses?

It's one thing to recognize the importance of managing expenses. It's quite another to know how to do it effectively. Here are a few tips to maximize the value of your cost-tracking efforts:

Create a Detailed Budget

It's hard to keep expenses in line when you make every decision on the fly. Things that seem important in one moment can stir significant regret later on. Also, it's difficult to keep an eye on the bigger picture.

One study suggested that half of business owners topped their budget by 40% or more. With the data provided by your comprehensive expense tracking, you can produce a more accurate budget. From there, you can make the optimal tactical decisions as you go about your daily routine.

Make It Routine

Waiting to tally your expenses until it's time to compose your financial statements can cause problems. By that point, some information will be lost. Plus, you'll face the massive task of scouring through months of receipts.

Instead, keep a running total as you go. Make compiling your expenses part of your everyday routine. That way, you'll have every scrap of data you need. Plus, it won't feel like such a daunting chore that you have to conquer in one giant effort.

Use Software/Online Tools

Luckily, technology is here to help. There are dozens of powerful software programs and online tools that can assist you in tracking your expenses. Find the one that suits you best and lean on it for the support you need.

Also, look for partnerships that ease your burden. Some online small business banks, for example, come with embedded tools. Suddenly, tracking expenses becomes a much easier task.

Look for Ways to Improve

Constantly look to trim your expenses. Even small cuts can add up over time. Plus, this vigilance will give you added incentive to maintain scrupulous records.

By knowing where you put your money, you can judge the value of each dollar you spend. You'll see which expenses lead to more revenue. And you'll understand which costs are just a waste.

By knowing where you put your money, you can judge the value of each dollar you spend.

Maximizing Profitability through Expense Management

When you run a small business, days can often pass in a blur. It seems like you have an unending list of tasks to perform and an unlimited number of intricate decisions to make.

Given this fast-paced lifestyle, keeping detailed records could become a secondary consideration. It gets hard enough to keep track of everything that happens. You're so busy running your day-to-day operations, you could lose sight of the bigger picture.

But tracking your expenses can help you create a business budget. This, in turn, lets you manage your startup better. In this way, learning to control your expenses will contribute significantly to long-term profitability.